All Categories

Featured

Table of Contents

- – What is Level Benefit Term Life Insurance and ...

- – What Are the Benefits of Voluntary Term Life I...

- – What is Term Life Insurance With Accelerated ...

- – How Term Life Insurance Can Secure Your Future

- – What is Term Life Insurance For Spouse and H...

- – The Basics: What is Short Term Life Insurance?

- – What is Voluntary Term Life Insurance? Compr...

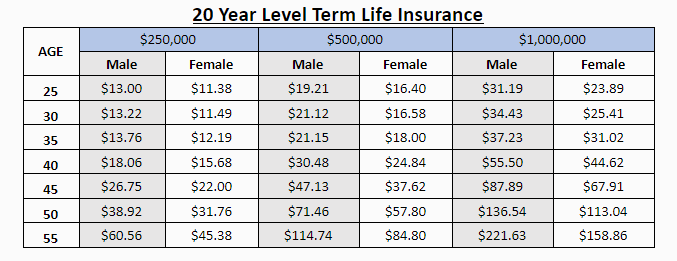

With this kind of degree term insurance coverage policy, you pay the same monthly costs, and your beneficiary or recipients would certainly receive the same advantage in case of your fatality, for the whole insurance coverage period of the plan. So how does life insurance policy job in regards to price? The expense of degree term life insurance coverage will depend upon your age and wellness in addition to the term size and protection quantity you choose.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Lady$1,000,00030$43.3135 Male$500,00020$20.7235 Female$750,00020$23.1340 Male$600,00015$22.8440 Woman$800,00015$27.72 Price quote based on rates for qualified Sanctuary Simple candidates in exceptional health and wellness. No matter of what insurance coverage you select, what the plan's money value is, or what the lump amount of the fatality advantage turns out to be, peace of mind is among the most important advantages associated with purchasing a life insurance plan.

Why would certainly somebody select a policy with a yearly sustainable premium? It might be an alternative to take into consideration for a person that requires protection only temporarily. A person who is between jobs but desires death benefit defense in location since he or she has financial debt or various other financial obligations might intend to think about an each year eco-friendly plan or something to hold them over till they start a brand-new task that supplies life insurance coverage.

What is Level Benefit Term Life Insurance and Why Choose It?

You can generally restore the policy annually which provides you time to consider your alternatives if you desire protection for longer. That's why it's helpful to acquire the appropriate amount and length of coverage when you first get life insurance, so you can have a reduced rate while you're young and healthy.

If you add essential unsettled labor to the house, such as kid care, ask yourself what it could cost to cover that caretaking work if you were no longer there. Make sure you have that insurance coverage in location so that your household gets the life insurance policy benefit that they need.

What Are the Benefits of Voluntary Term Life Insurance?

For that set amount of time, as long as you pay your premium, your price is steady and your beneficiaries are shielded. Does that imply you should constantly pick a 30-year term length? Not always. As a whole, a much shorter term plan has a lower costs rate than a much longer policy, so it's smart to select a term based on the predicted size of your financial responsibilities.

These are very important variables to maintain in mind if you were assuming about choosing a long-term life insurance policy such as a whole life insurance coverage policy. Numerous life insurance policy policies offer you the choice to add life insurance cyclists, believe extra advantages, to your policy. Some life insurance policy policies come with riders built-in to the expense of costs, or cyclists might be readily available at a price, or have actually charges when worked out.

What is Term Life Insurance With Accelerated Death Benefit? How It Works and Why It Matters?

With term life insurance, the interaction that a lot of individuals have with their life insurance policy firm is a month-to-month costs for 10 to 30 years. You pay your month-to-month premiums and hope your family members will never ever need to use it. For the team at Place Life, that appeared like a missed out on possibility.

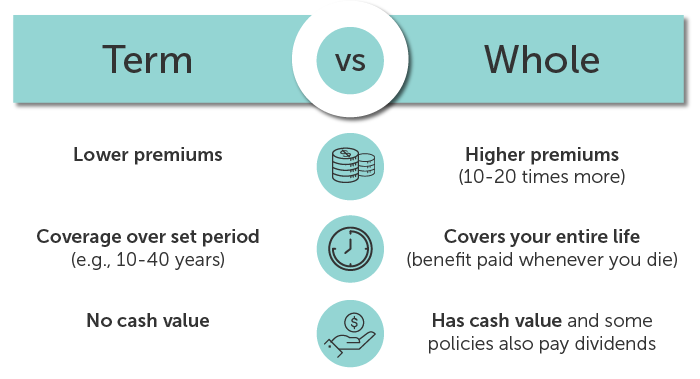

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. top-rated life insurance companies from brokers. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

Our company believe navigating choices regarding life insurance, your personal financial resources and overall wellness can be refreshingly easy (Level term life insurance policy). Our material is produced for academic purposes just. Place Life does not back the companies, products, services or approaches talked about here, yet we hope they can make your life a little less tough if they are a fit for your circumstance

This product is not intended to supply, and need to not be counted on for tax, legal, or investment suggestions. People are motivated to seed suggestions from their own tax obligation or lawful guidance. Review even more Place Term is a Term Life Insurance Policy Policy (DTC and ICC17DTC in specific states, including NC) provided by Massachusetts Mutual Life Insurance Coverage Business (MassMutual), Springfield, MA 01111-0001 and provided solely with Haven Life insurance policy Firm, LLC.

The score is as of Aril 1, 2020 and is subject to alter. Haven Life And Also (And Also) is the marketing name for the And also rider, which is consisted of as component of the Sanctuary Term policy and supplies accessibility to extra services and benefits at no price or at a discount.

How Term Life Insurance Can Secure Your Future

Discover extra in this overview. If you depend on someone monetarily, you might ask yourself if they have a life insurance policy policy. Find out exactly how to find out.newsletter-msg-success,. newsletter-msg-error display screen: none;.

When you're younger, term life insurance policy can be a simple method to protect your liked ones. However as life adjustments your monetary priorities can too, so you may want to have whole life insurance policy for its lifetime protection and added advantages that you can utilize while you're living. That's where a term conversion can be found in.

What is Term Life Insurance For Spouse and How Does It Work?

Authorization is assured no matter your health and wellness. The premiums will not raise as soon as they're set, but they will increase with age, so it's an excellent idea to secure them in early. Discover out more concerning exactly how a term conversion works.

Words "degree" in the expression "degree term insurance policy" means that this sort of insurance policy has a fixed costs and face quantity (death advantage) throughout the life of the policy. Just put, when individuals speak about term life insurance policy, they commonly describe level term life insurance. For most of people, it is the most basic and most cost effective selection of all life insurance coverage types.

The Basics: What is Short Term Life Insurance?

Words "term" right here describes a provided number of years during which the level term life insurance policy remains active. Level term life insurance is among one of the most prominent life insurance policy policies that life insurance policy suppliers offer to their customers because of its simpleness and cost. It is additionally easy to compare degree term life insurance quotes and get the most effective costs.

The mechanism is as complies with: Firstly, pick a plan, survivor benefit amount and policy period (or term length). Pick to pay on either a regular monthly or yearly basis. If your early death takes place within the life of the plan, your life insurance firm will pay a round figure of survivor benefit to your determined recipients.

What is Voluntary Term Life Insurance? Comprehensive Guide

Your degree term life insurance coverage policy runs out once you come to the end of your plan's term. Choice B: Purchase a new degree term life insurance plan.

1 Life Insurance Policy Statistics, Information And Market Trends 2024. 2 Expense of insurance policy rates are figured out utilizing methodologies that vary by firm. These prices can vary and will normally boost with age. Prices for energetic staff members may be various than those available to ended or retired staff members. It is necessary to take a look at all elements when examining the overall competitiveness of prices and the worth of life insurance policy coverage.

Table of Contents

- – What is Level Benefit Term Life Insurance and ...

- – What Are the Benefits of Voluntary Term Life I...

- – What is Term Life Insurance With Accelerated ...

- – How Term Life Insurance Can Secure Your Future

- – What is Term Life Insurance For Spouse and H...

- – The Basics: What is Short Term Life Insurance?

- – What is Voluntary Term Life Insurance? Compr...

Latest Posts

Final Expense Protect Insurance

Death And Burial Insurance

Funeral Insurance Us

More

Latest Posts

Final Expense Protect Insurance

Death And Burial Insurance

Funeral Insurance Us