All Categories

Featured

Table of Contents

If you choose level term life insurance policy, you can budget for your premiums since they'll remain the exact same throughout your term. Plus, you'll recognize specifically just how much of a death benefit your recipients will get if you pass away, as this quantity will not change either. The prices for level term life insurance will rely on several variables, like your age, health and wellness condition, and the insurer you select.

Once you go with the application and medical examination, the life insurance policy company will review your application. They should notify you of whether you have actually been approved quickly after you use. Upon approval, you can pay your very first costs and sign any pertinent documents to ensure you're covered. From there, you'll pay your costs on a regular monthly or yearly basis.

Aflac's term life insurance coverage is hassle-free. You can pick a 10, 20, or three decades term and enjoy the included comfort you should have. Collaborating with an agent can aid you locate a plan that functions best for your demands. Discover more and get a quote today!.

As you try to find means to secure your economic future, you have actually most likely discovered a wide range of life insurance policy alternatives. does term life insurance cover accidental death. Choosing the best coverage is a big decision. You want to discover something that will certainly aid support your loved ones or the causes crucial to you if something happens to you

Many people lean toward term life insurance coverage for its simplicity and cost-effectiveness. Level term insurance, nevertheless, is a kind of term life insurance policy that has constant payments and a changeless.

Effective Level Premium Term Life Insurance Policies

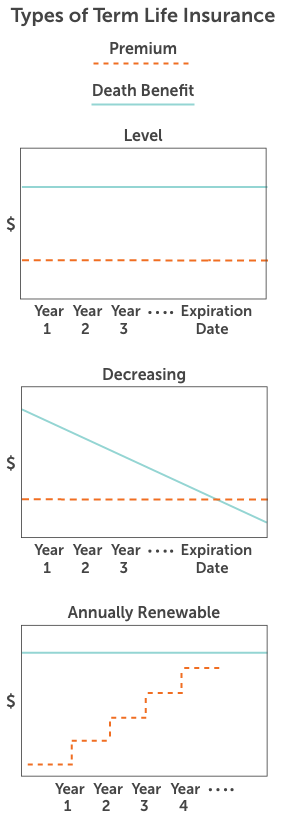

Level term life insurance policy is a part of It's called "level" since your costs and the advantage to be paid to your liked ones stay the very same throughout the agreement. You won't see any adjustments in expense or be left wondering about its value. Some agreements, such as yearly renewable term, may be structured with costs that raise in time as the insured ages.

Taken care of fatality benefit. This is additionally set at the start, so you can recognize precisely what fatality benefit amount your can anticipate when you pass away, as long as you're covered and current on costs.

This often between 10 and three decades. You consent to a set premium and survivor benefit throughout of the term. If you die while covered, your fatality benefit will certainly be paid out to enjoyed ones (as long as your premiums are up to day). Your recipients will understand in advance just how much they'll obtain, which can help for planning functions and bring them some economic security.

You might have the choice to for another term or, much more likely, restore it year to year. If your contract has actually a guaranteed renewability condition, you might not need to have a brand-new clinical examination to maintain your protection going. Nevertheless, your costs are likely to boost because they'll be based upon your age at revival time (decreasing term life insurance is often used to).

With this alternative, you can that will last the remainder of your life. In this situation, again, you may not need to have any kind of brand-new clinical exams, however costs likely will climb as a result of your age and brand-new coverage. a term life insurance policy matures. Various companies offer numerous choices for conversion, make sure to understand your options before taking this step

Flexible Level Term Life Insurance Definition

Consulting with a monetary advisor likewise might aid you identify the course that straightens finest with your general approach. Many term life insurance coverage is level term for the duration of the agreement period, however not all. Some term insurance policy might feature a premium that raises gradually. With decreasing term life insurance policy, your fatality advantage decreases with time (this kind is frequently secured to specifically cover a long-term financial debt you're paying off).

And if you're established for eco-friendly term life, after that your costs likely will go up annually. If you're discovering term life insurance policy and want to guarantee simple and foreseeable monetary defense for your household, degree term may be something to think about. As with any type of type of coverage, it may have some restrictions that do not meet your needs.

Proven A Term Life Insurance Policy Matures

Typically, term life insurance policy is a lot more inexpensive than irreversible insurance coverage, so it's an economical means to protect financial security. Versatility. At the end of your agreement's term, you have multiple options to continue or carry on from coverage, commonly without needing a clinical examination. If your budget plan or coverage needs change, survivor benefit can be minimized in time and lead to a lower costs.

As with various other kinds of term life insurance coverage, once the agreement finishes, you'll likely pay greater costs for insurance coverage since it will certainly recalculate at your current age and health. If your financial scenario modifications, you might not have the required protection and may have to buy added insurance policy.

However that doesn't suggest it's a suitable for everybody. As you're buying life insurance policy, right here are a few vital variables to think about: Budget. One of the benefits of level term coverage is you understand the cost and the fatality advantage upfront, making it easier to without bothering with increases in time.

Age and health and wellness. Generally, with life insurance policy, the much healthier and younger you are, the extra inexpensive the protection. If you're young and healthy, it might be an appealing alternative to secure low premiums currently. Financial responsibility. Your dependents and financial duty play a function in identifying your coverage. If you have a young household, for example, level term can aid supply economic assistance throughout critical years without paying for protection longer than needed.

1 All motorcyclists are subject to the terms and problems of the cyclist. Some states may vary the terms and problems.

2 A conversion credit report is not offered for TermOne plans. 3 See Term Conversions area of the Term Collection 160 Item Overview for exactly how the term conversion debt is identified. A conversion debt is not available if costs or costs for the brand-new policy will be forgoed under the terms of a cyclist giving disability waiver benefits.

Budget-Friendly Term Vs Universal Life Insurance

Term Collection items are released by Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Policy Firm of The Golden State, LLC in CA; Equitable Network Insurance Coverage Agency of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a kind of life insurance coverage plan that covers the insurance policy holder for a certain quantity of time, which is known as the term. Terms typically vary from 10 to 30 years and boost in 5-year increments, providing level term insurance policy.

Table of Contents

Latest Posts

Final Expense Protect Insurance

Death And Burial Insurance

Funeral Insurance Us

More

Latest Posts

Final Expense Protect Insurance

Death And Burial Insurance

Funeral Insurance Us